Best Brokerage Checking Accounts for 2025

Written by Sam Levine, CFA, CMT

Edited by Carolyn Kimball

Fact-checked by Steven Hatzakis

Reviewed by Blain Reinkensmeyer

Rather than juggling usernames and passwords for your financial accounts across different providers, you can keep your finances consolidated within a single firm by using a bank brokerage. While the lack of diversification can be a risk, bank brokers often offer incentives for people who open multiple types of financial accounts with a large overall balance.

To determine which online brokerage offers the best bank broker experience, we evaluated and tested (when appropriate) cash management tools across 14 brokers, starting with traditional banking products — e.g., checking accounts, savings accounts, debit cards, credit cards, and mortgages. Then I looked for other features such as mobile check deposit, debit card ATM fee reimbursement, no-fee banking, and access to local branch offices.

Why you can trust StockBrokers.com

Since 2009, we've helped over 20 million visitors research, compare, and choose an online broker. Our writers have collectively placed thousands of trades over their careers. Here's how we test.

Best Bank Brokerages

Here are the best online brokers for banking services in 2025.

compare_arrows Compare trading platforms head-to-head

Use the broker comparison tool to compare over 150 different account features and fees.

Winners Summary

Best bank brokerage - Merrill Edge (Bank of America)

| Company | Minimum Deposit | Stock Trades | Options (Per Contract) |

Merrill Edge Merrill Edge

|

$0.00 | $0.00 | $0.65 |

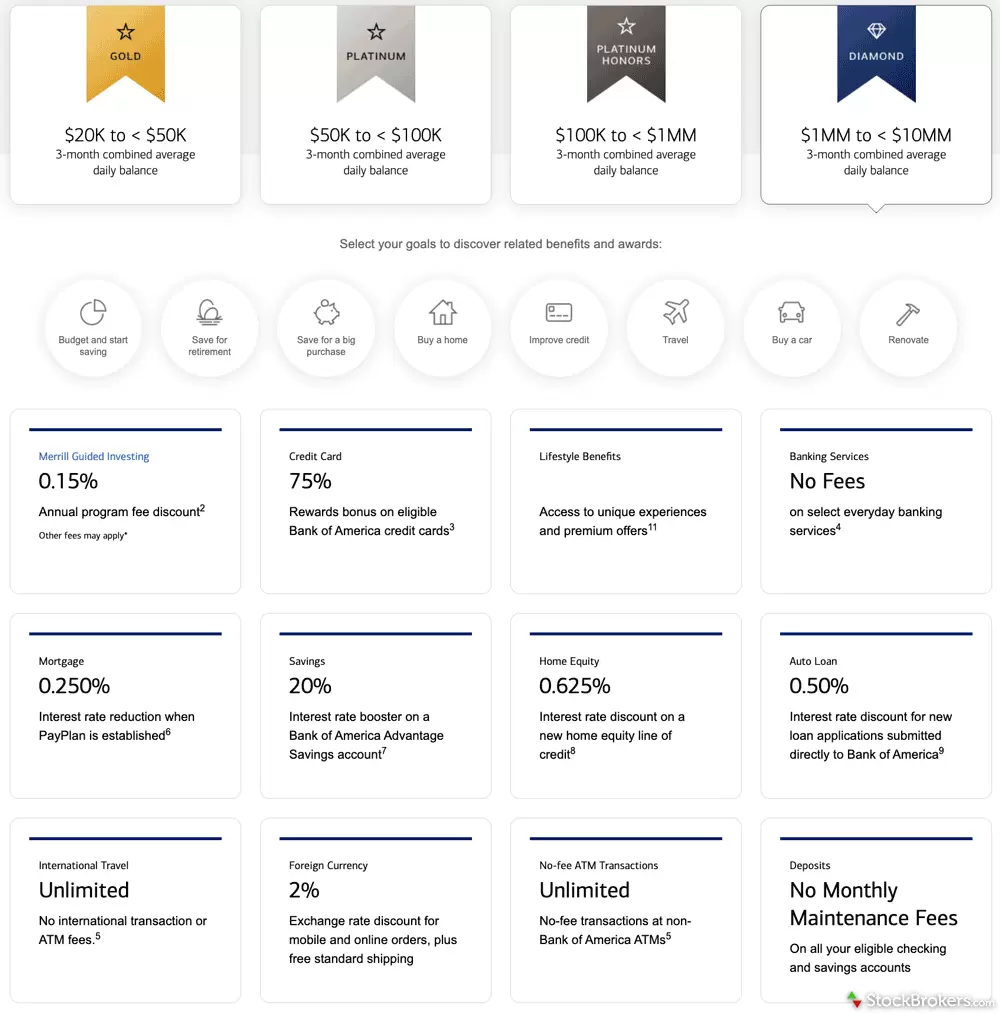

Merrill Edge, part of Bank of America, provides a comprehensive suite of personal banking products, including savings accounts, checking accounts, and credit cards. Merrill's integrated platform for your banking and brokerage needs offers seamless account management, particularly for customers participating in its Preferred Rewards program. One of my favorite features is the ease with which you can move funds between your bank and brokerage accounts.

Preferred Deposits: For those interested in higher returns on their cash holdings, Merrill Edge Preferred Deposits require a minimum initial deposit of $100,000 and offer variable interest rates, which are typically much higher than what you'd find in standard cash sweep accounts. As of February 4th, 2025, the Preferred Deposit rate was 3.67%, significantly higher than the 0.01% offered for cash sweep accounts with balances under $1 million. However, it's important to note that funds in your Preferred Deposit account must be manually deposited and withdrawn in increments of $1,000, and they won’t be automatically withdrawn to cover trades or margin requirements.

Trading platforms: Merrill also excels as an online brokerage platform, offering no account minimums and $0 commission stock and ETF trades. Trades gain access to Merrill Lynch’s research tools, which are great for beginner investors and those managing a combination of banking and brokerage needs. Merrill Edge’s platform features tools like Stock Story, Fund Story, and Portfolio Story to simplify investing. While Merrill doesn't offer fractional shares or paper trading, it remains one of my top choices for new investors and those looking for a low-cost, well-supported trading environment. Check out my Merrill Edge review to learn more.

Bank of America Preferred Rewards tiers

Merrill Edge broker research

Best financial planning tool - J.P. Morgan Self-Directed Investing (Chase Bank)

| Company | Minimum Deposit | Stock Trades | Options (Per Contract) |

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

$0.00 | $0.00 | $0.65 |

J.P. Morgan Self-Directed Investing provides a comprehensive, user-friendly platform that simplifies money and asset management for Chase Bank customers, the largest bank in the U.S. Customers enjoy benefits like instant transfers, mobile check deposit, universal login, and access to high-quality J.P. Morgan proprietary research. The platform's Wealth Plan feature helps clients prioritize financial goals, create budgets, and design investment strategies. With no minimum deposit and $0 commissions for stock and ETF trades, J.P. Morgan is a convenient choice for casual investors and beginner stock traders.

Robo-advisor services: For traders who prefer a hands-off approach, J.P. Morgan offers Automated Investing, a robo-advisor service that manages money based on individual goals for a low fee. This service requires a $500 minimum deposit (unlike the broker's Self-Directed offering, which has no minimum requirement).

Trading platforms:All that said, the broker's platform is fairly basic and lacks the advanced features favored by active traders and experienced investors. While J.P. Morgan excels at integrating banking and investing with ease, its website and mobile trading app may frustrate those looking for more sophisticated tools or a downloadable trading platform. Serious investors may find more robust offerings at other firms, such as Merrill Edge, which provides additional research tools and more customization for traders.

While convenient for Chase Bank customers, investors who prioritize more advanced features may need to explore competitors like Merrill Edge for a broader range of tools. Read my J.P. Morgan Review to learn more.

J.P. Morgan broker research

Best for beginner investors - Ally Invest (Ally Bank)

| Company | Minimum Deposit | Stock Trades | Options (Per Contract) |

Ally Invest Ally Invest

|

$0.00 | $0.00 | $0.50 |

Ally Invest delivers a robust banking and brokerage combination, offering universal account access and the ability to transfer funds instantly between accounts. Investors benefit from $0 commissions on no-load mutual funds and access to a broad range of bonds, backed by detailed muni bond research (though I feel that a bond ladder tool would really enhance the broker's bond trading experience). Ally’s personal wealth management services – available for clients with $100,000 in assets at a 0.85% annual fee – also add significant value.

Trading platforms: That said, Ally’s trading tools don’t quite match the advanced features offered by brokers like Interactive Brokers or tastytrade. The absence of crypto, futures, or forex trading might deter some investors. Despite these limitations, Ally Invest’s platform is highly user-friendly for beginner investors. Learn more by reading my Ally Invest review.

Ally Invest broker research

Bank Broker Pricing and Features Comparison

Here's a pricing and features comparison of the best bank brokers side by side. To compare brokers in other areas, see our online brokerage comparison tool.

| Feature |

Merrill Edge Merrill Edge

|

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

Ally Invest Ally Invest

|

Fidelity Fidelity

|

|---|---|---|---|---|

| Minimum Deposit info | $0.00 | $0.00 | $0.00 | $0.00 |

| Stock Trades info | $0.00 | $0.00 | $0.00 | $0.00 |

| ETF Trade Fee info | $0.00 | $0.00 | $0.00 | $0.00 |

| Mutual Fund Trade Fee info | Varies info | $0 | $0.00 | Varies info |

| Options (Per Contract) info | $0.65 | $0.65 | $0.50 | $0.65 |

| Futures (Per Contract) info | (Not offered) | (Not offered) | (Not offered) | (Not offered) |

| Broker Assisted Trade Fee info | $29.95 | Varies | $20 | $32.95 |

Here is a comparison of the various banking products each broker offers.

| Feature |

Merrill Edge Merrill Edge

|

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

Ally Invest Ally Invest

|

Fidelity Fidelity

|

|---|---|---|---|---|

| Bank (Member FDIC) info | Yes | Yes | Yes | No |

| Checking Accounts info | Yes | Yes | Yes | No |

| Savings Accounts info | Yes | Yes | Yes | No |

| Credit Cards info | Yes | Yes | Yes | Yes |

| Debit Cards info | Yes | Yes | Yes | Yes |

| Mortgage Loans info | Yes | Yes | Yes | Yes |