Winners Summary

Best stock broker - Charles Schwab

| Company |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Charles Schwab Charles Schwab

|

$0.00 |

$0.00 |

$0.65 |

Charles Schwab takes the crown as the #1 Overall Broker of 2025, and for good reason — it offers a tailored solution for every type of investor, no matter your experience level or investment goals. From beginner investors to active traders, Schwab doesn’t just provide a high-level answer; it delivers a solution designed specifically for your needs.

Charles Schwab stands out in the following areas:

A perfect match in TD Ameritrade: Any gaps in its offering were seamlessly filled with the acquisition of TD Ameritrade, resulting in an online trading platform that scores top marks in almost every category we evaluate. For beginners, Schwab’s Investor Starter Kit and Investing 101 programs bridge education and application, making it easy to learn while building a portfolio. For goal-oriented investors, Schwab offers robust tools to set, track, and maintain financial goals, all supported by practical, contextually placed research and education that help guide decision-making.

Portfolio building: What truly sets Schwab apart is its ability to grow with you. If you start as a passive investor, Schwab has everything you need to succeed. But as you evolve in your investing journey, Schwab keeps pace. Active traders gain access to the thinkorswim suite, one of the most advanced trading platforms on the market, offering desktop and mobile tools for technical analysis, position pairing, and multi-leg options strategies. Schwab integrates useful features like in-depth analyst reports, valuation metrics, and fixed-income research with “how to use this” sections that ensure even complex data is actionable.

Advanced tools and insights: Whether you’re scalping gamma, trading iron condors, or diving deep into fundamental analysis, Schwab can handle it. It’s rare to find a stock broker that not only meets investors where they are but stays with them as they grow. Schwab is that broker, offering unmatched tools, education, and support for every stage of your investing journey.

Visit my comprehensive Charles Schwab review to learn more about the thinkorswim platform and find out more about its offerings.

Best for advanced tools and global markets - Interactive Brokers

| Company |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Interactive Brokers Interactive Brokers

|

$0.00 |

$0.00 |

$0.65 |

Interactive Brokers (IBKR) secures the number two spot for best stock broker for 2025 in what was an incredibly tight race. While IBKR is best known for catering to advanced traders and professionals, it also offers features that make it surprisingly accessible to a broader audience.

Interactive Brokers stands out in the following areas:

Platforms & tools: Whether you’re managing a multi-million-dollar portfolio or just starting your investing journey, IBKR has a platform tailored to your needs. Tools like the multisort screener allow you to filter and rank investments with intuitive data visualizations, making complex decisions easier for new investors to understand. Add in its comprehensive goal-planning tools, offering asset allocation guidance, expense tracking, and cash flow projections, and IBKR proves it excels at both institutional-grade trading and long-term financial planning.

Advanced tools and insights: Advanced traders can harness powerful analytics like Sharpe ratio, beta, and correlation metrics, while socially conscious investors can customize portfolios to align with their values. Beginners, meanwhile, benefit from IBKR’s retirement planner and free account consolidation tools, which provide a centralized view of all financial assets.

Educational resources: Although the platform’s learning curve may feel steep, its CFA-accredited courses and other educational resources ensure that investors at any level can grow into its capabilities. IBKR’s ability to serve the most sophisticated traders while offering beginner-friendly tools and global market access makes it a standout choice for any investor, proving that you don’t need a massive portfolio to take advantage of one of the industry’s most robust brokerage platforms.

Visit my full review of Interactive Brokers to learn more about its entire offering.

Best for customer support and financial planning - Fidelity

| Company |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Fidelity Fidelity

|

$0.00 |

$0.00 |

$0.65 |

Fidelity earns its spot as the third-best brokerage account for 2025 and distinguishes itself as one of the most versatile online trading platforms I’ve tested.

Fidelity stands out in the following areas:

Research: Its research tools are exceptional — Fidelity’s economic calendar is my go-to for tracking key market events, offering context that explains the "why" behind market movements. The thematic stock screener, highlighting trends like AI or biotech, is another favorite, making it easy to uncover tailored investment opportunities.

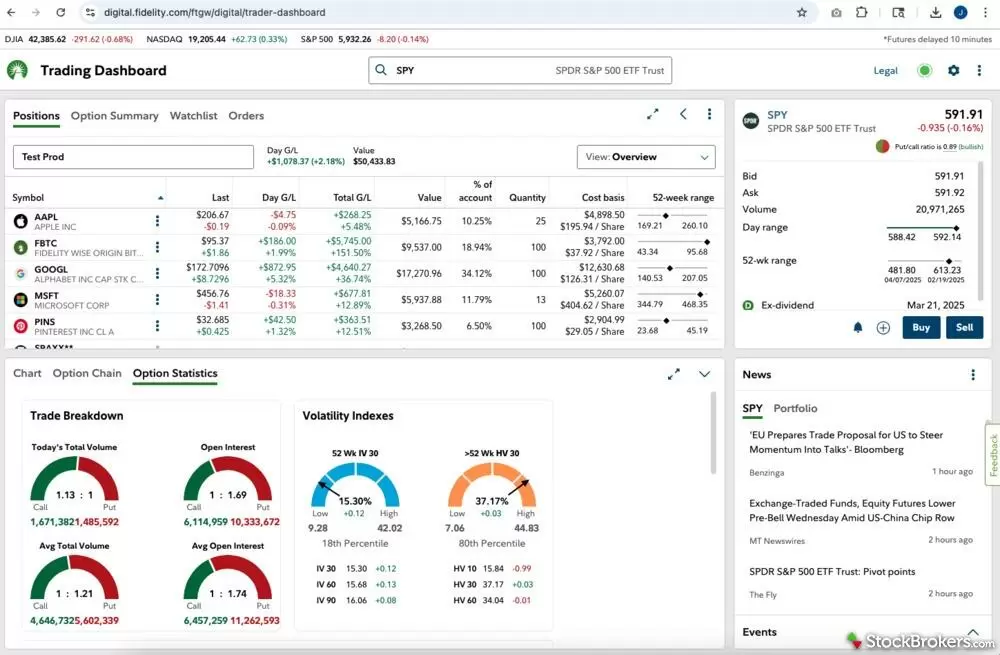

Platforms & tools: Fidelity’s widgetized dashboard adapts seamlessly to different investor needs, simplifying navigation for beginners while offering extensive customization for advanced users. As an options trader, I found the OptionsPlay integration invaluable, presenting strategies in an intuitive format, offering income-focused ideas, and flagging potential risks like exercises or earnings announcements.

Tax and retirement planning: While Fidelity excels in retirement planning, its offerings go far beyond that. With tax-advantaged business plans, specialty accounts for charitable giving, and custodial accounts for minors, Fidelity provides solutions for nearly every financial goal. The fixed-income dashboard is another standout, delivering detailed insights like cash flow views and tax-exempt comparisons for bond investors. Fidelity’s portfolio management tools, including external account linking and contextual education, make managing investments straightforward and efficient.

Customer support: Their customer support is equally impressive, with specialized teams for beginners, active traders, and options investors, ensuring expert assistance at every level. Fidelity ranked #1 in our exhaustive customer service testing for 2025.

Whether you’re planning for retirement, exploring global markets, or refining advanced strategies, Fidelity’s innovative tools and reliable platform make it a superb choice. Check out my full review of Fidelity to get all my thoughts about this broker and explore more of its offerings.

Best online brokers comparison

Our comprehensive table below breaks down the top seven online stock brokers based on overall rating, minimum deposit, price of stock trades, and the price of an options contract per side, making it easier for you to pinpoint the right fit for your investing style. For a more detailed analysis, be sure to check out our compare tool.

FAQs

What is a brokerage account?

A brokerage account is an account provided by a brokerage firm that allows you to buy and sell stocks, bonds, ETFs, and mutual funds using an online trading platform. Think of it as your direct link to the markets, giving you access to a variety of investment products and the tools you need to build and manage your portfolio. Depending on what the stock broker offers, you might also be able to explore more advanced trading options, including complex derivatives such as options and futures, or use helpful features like in-depth research and portfolio analysis to guide your decisions.

There are different flavors of brokerage accounts tailored to your investing style. With a cash account, you pay for each investment in full at the time of purchase, keeping things simple and limiting your risk, but it’s important to be mindful of settlement dates to avoid any penalties for premature trading. On the other hand, a margin account lets you borrow funds to potentially boost your buying power, which can amplify gains but also comes with its own drawbacks. You’ll need to pay interest on the borrowed amount, and if your investments decline in value, you could face a margin call requiring you to deposit more funds or liquidate positions, increasing the risk and complexity of your investment strategy.

How much money do I need to open a brokerage account?

The amount of money needed to open a brokerage account varies by firm. While some stock brokers require a minimum deposit, others have no minimum at all, which is increasingly becoming more common. However, even with no set minimum, you'll need enough funds to purchase at least a fractional share of the investment you're interested in, ensuring you can start building your portfolio right away.

Even as little as $5 is enough to start investing with at a broker like Charles Schwab, which offers Stock Slices — fractional shares of S&P 500 companies. For other ideas on where to invest your initial capital, read more about how to invest $100, $1,000, $10,000 or more.

Can I have multiple brokerage accounts?

Yes, you can have multiple brokerage accounts. Many investors choose to open accounts with different brokers to access unique tools, optimize fees, or separate investment strategies. This approach can offer enhanced portfolio management and diversification while also allowing you to take advantage of each broker's specific strengths and features.

What are some tips for choosing a stock broker?

When choosing a stock broker, it's important to consider your unique trading style and long-term investment goals. Here are some key factors to help you narrow down your options:

- Great for Mobile Trading: If you prefer trading on the go, look for brokers with top-rated mobile apps. Check out our mobile trading guide.

- Best for IRAs: For retirement planning, choose brokers offering robust IRA options and expert retirement planning tools. See our IRA guide.

- Options Trading: If options are your focus, look for brokers offering advanced options trading tools, risk management features, and clear pricing structures. Head on over to our guide to the best options trading platforms.

- Futures Trading: For those interested in futures, select a broker with specialized platforms and competitive margins that cater to fast-paced markets. Visit our guide to the best brokers for futures trading.

- Low Fees & Minimum Deposits: Compare commission structures and account minimums to ensure you're getting a cost-effective solution that fits your budget. Check out our guide to the best free stock trading accounts.

- Powerful Research & Tools: Opt for brokers that provide comprehensive market research, analysis tools, and educational resources to support your trading decisions. Visit our guide to the best brokers for research or our guide to the best brokers for education.

- User-Friendly Platform & Support: A well-designed, intuitive trading platform paired with reliable customer support can make all the difference in your investing experience. To that end, head on over to our guide to the best brokers for user experience.

What stock broker offers the best trading platform?

Charles Schwab offers the best online trading platform for most people due to its strong overall rankings across key categories, particularly in its ease of use and mobile trading apps. That said, there will often be specific concerns for you as a trader or investor that'll make a different broker an even better fit. The brokerage account testing team at StockBrokers.com maintained live accounts at 16 brokers in 2025 and used them to evaluate each broker’s tools, ease of use, data, design, and content. Here are the five top-scoring brokerage firms and the accolades won in the StockBrokers.com Annual Awards for 2025:

- Charles Schwab —

: Our pick for #1 Overall Broker, including Best for Research, Platform & Tools, Mobile Trading Apps, Education, and Ease of Use. We also found it to be Best for Beginners, Passive Investors, and Casual Investors. Schwab also won industry awards for #1 Investor App, #1 Desktop Trading Platform, #1 Client Dashboard, #1 Stock Trading Platform, #1 Bond Trading Platform, and #1 Overall Client Experience.

: Our pick for #1 Overall Broker, including Best for Research, Platform & Tools, Mobile Trading Apps, Education, and Ease of Use. We also found it to be Best for Beginners, Passive Investors, and Casual Investors. Schwab also won industry awards for #1 Investor App, #1 Desktop Trading Platform, #1 Client Dashboard, #1 Stock Trading Platform, #1 Bond Trading Platform, and #1 Overall Client Experience.

- Interactive Brokers —

: Best Range of Investments and Best for Active Traders. It also won industry awards for #1 International Trading, #1 Ethical Investing, #1 Professional Trading, #1 Margin Trading, and #1 Trader App.

: Best Range of Investments and Best for Active Traders. It also won industry awards for #1 International Trading, #1 Ethical Investing, #1 Professional Trading, #1 Margin Trading, and #1 Trader App.

- Fidelity —

: Best for Customer Service, Retirement Accounts, and High Net Worth Investors.

: Best for Customer Service, Retirement Accounts, and High Net Worth Investors.

- E*TRADE from Morgan Stanley —

: Industry award for #1 Web Trading Platform.

: Industry award for #1 Web Trading Platform.

- Merrill Edge —

: Best Bank Brokerage and industry awards for #1 New Tool, and #1 Bond Research

: Best Bank Brokerage and industry awards for #1 New Tool, and #1 Bond Research

Our testing

Why you should trust us

Jessica Inskip is Director of Investor Research at StockBrokers.com, bringing 15 years of experience in brokerage and trading strategy. A former FINRA-licensed rep, she held Series 7, 63, 66, and 4 licenses. Jessica focuses on investor education and brokerage industry research, appears regularly on CNBC, Bloomberg, The Schwab Network, Fox Business, and Yahoo! Finance, and hosts the Market MakeHer podcast.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Trading platforms tested

We tested 14 online trading platforms for this guide: